Breaking Nvidia Q3 Results: AI Growth and Investment Opportunities

Breaking Nvidia Q3 Results: AI Growth and Investment Opportunities

Nvidia has reported another blockbuster quarter and once again, the company at the heart of the artificial intelligence (AI) boom has exceeded Wall Street’s expectations. But with the stock trading at a massive premium and global AI spending accelerating at historic speed, investors are asking a crucial question: Is Nvidia still a buy after Q3 fiscal 2026 results, or is the AI buildout nearing its peak?

Nvidia’s Q3 Results: Another Record-Breaking Quarter

Nvidia posted $57 billion in revenue, a massive 62% year-over-year increase, powered almost entirely by data-center demand. That segment alone contributed $51.2 billion, beating analyst estimates by about $2 billion.

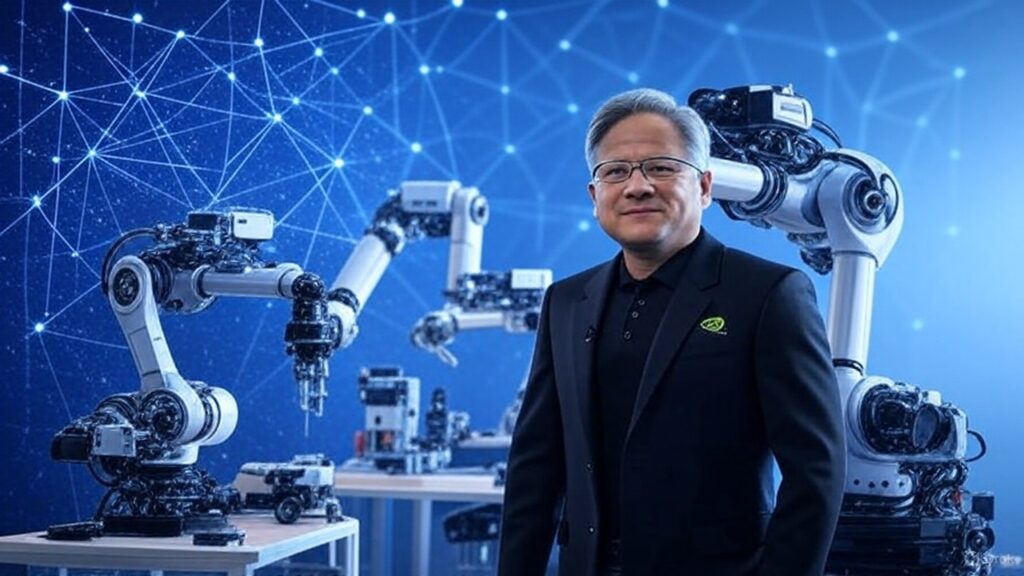

CEO Jensen Huang also confirmed that the company’s newest generation of Blackwell GPUs is effectively sold out for the next 12 months, a sign that demand continues to outpace supply.

For investors, the numbers are impressive. But the real debate is whether this level of AI infrastructure spending can continue for years… or whether the industry is approaching a limit.

Why Nvidia Still Dominates the AI Hardware Race

Every major company training or deploying AI models relies on Nvidia’s GPUs. These chips are built to perform thousands of operations at once, making them ideal for powering everything from large language models to advanced machine learning systems.

The new Blackwell NVL72 racks deliver up to 30× higher inference throughput than systems built on the previous H100 architecture, while maintaining similar power levels a huge leap in performance.

Nvidia currently manufactures around 1,000 server racks per week, and most Blackwell inventory through 2025 has already been reserved by major cloud players including Microsoft, Amazon, and Meta.

Competition Exists but Switching Costs Are Huge

AMD touts its MI325X as offering up to 40% better inference throughput than Nvidia’s H200 in certain workloads, and Intel is pushing its Gaudi 3 chips. But Nvidia still commands over 90% of the cloud AI GPU market, largely thanks to CUDA, the software ecosystem that developers have built around for years. Leaving CUDA isn't impossible, but it requires massive retraining, recoding, and capital investment.

That advantage remains Nvidia’s biggest moat.

The Spending Question: Are We Nearing an AI Capex Peak?

Several forecasts including Nvidia’s internal projections suggest that global AI and data center spending could reach $500 billion to $600 billion annually by 2030. Tech giants like Alphabet, Microsoft, Amazon, and Meta together are already on pace to surpass $300 billion in annual capital expenditures, with an increasing share flowing into AI infrastructure.

With Nvidia’s market cap around $4.5 trillion and trading at roughly mid-40s times trailing earnings, skeptics argue that expectations may be too high.

Some analysts even draw parallels to Cisco during the dot-com era, when heavy demand for networking equipment suddenly reversed, driving its stock down nearly 90%.

Why Today’s AI Buildout Looks Different From Past Tech Bubbles

Despite concerns, three factors suggest this may be less of a bubble and more of a long-term technology shift:

1. Real, Monetizable Use Cases Already Exist

AI applications are generating measurable returns in areas like:

- customer service automation

- coding assistance

- drug discovery

- autonomous systems

Unlike the dot-com era, the AI buildout is supporting revenue-producing products.

2. Performance Gains Are Still Explosive

Blackwell’s 30× inference improvement shows that each new generation isn’t incremental, it’s transformational. The follow-up “Rubin” architecture, expected to ship in 2026, may continue this trend.

3. The Spend Is Coming From Cash-Rich Giants

Microsoft, Amazon, Alphabet, and Meta are not speculative startups. These firms have the balance sheets and strategic incentive to continue multiyear AI investments.

However, this doesn’t eliminate risk. If AI revenue growth slows or monetization lags, these companies could reduce spending and Nvidia would feel it immediately.

Risks Investors Should Still Watch

Supply Chain Bottlenecks

Nvidia’s Blackwell chips rely on TSMC’s CoWoS-L packaging, which is already booked well into 2026. High-bandwidth memory (HBM) shortages also pose a constraint, with supply controlled by only Samsung, SK hynix, and Micron.

Margin Pressure

Non-GAAP gross margin for Q3 was 73.6%, slightly below last year’s 75%, though higher than last quarter’s 72.7%. Management expects a return to around 75% in Q4.

Loss of the Chinese Market

U.S. export restrictions pushed Nvidia’s AI GPU market share in China from 95% to nearly zero, cutting off what was once a major source of demand.

Slower Growth Ahead

Nvidia guided Q4 revenue to approximately $65 billion, which is strong — but represents a slower rate of acceleration compared to earlier explosive quarters.

Is Nvidia Still a Buy? The Long-Term Case

The investment thesis ultimately depends on your belief about the AI cycle.

If AI continues expanding like cloud computing or mobile did, Nvidia remains the most important infrastructure supplier in the world and arguably still undervalued relative to long-term demand.

If, however, AI spending peaks in the near future, Nvidia’s valuation leaves little margin for error.

MoneyMind Finance Take

Based on current data, the evidence leans toward continued transformation, not a bubble:

- AI workloads are rising exponentially

- New models require more compute, not less

- Enterprise adoption is accelerating

- Nvidia maintains the strongest ecosystem and market share

For long-term investors comfortable with volatility, Nvidia still represents a leading, high-conviction pick in the AI infrastructure space.

Disclaimer

This article is for informational and educational purposes only and does not constitute financial advice. Always conduct your own research or consult a licensed financial professional before making investment decisions.