Nvidia Q4 Earnings Beat Expectations — What Investors Should Know

Nvidia Q4 Earnings Beat Expectations — What Investors Should Know

Nvidia once again reinforced its dominance in the artificial intelligence hardware market, issuing a fourth-quarter revenue outlook that surpassed analysts’ projections. The company’s latest guidance highlights how demand for AI processors continues to grow even as debates intensify over whether the industry is entering a valuation bubble.

Nvidia Projects Strong Q4 Revenue Amid AI Investment Boom

In its newly released forecast, Nvidia said it expects fourth-quarter revenue of $65 billion, plus or minus 2%, a figure that easily clears the $61.66 billion average estimate compiled by LSEG.

This performance signals that AI infrastructure spending, especially by large cloud providers remains a powerful driver despite concerns about stretched market valuations.

The company’s outlook offers a critical read for global investors who have poured billions into AI-related buildouts. With Nvidia sitting at the center of this ecosystem, its guidance acts as a real-time indicator of whether enterprise adoption is keeping pace with investor enthusiasm.

Market Reaction: Shares Rebound After Recent Pullback

Nvidia stock climbed more than 4% in after-hours trading following the announcement.

This comes after shares slid nearly 8% in November, a rare pullback for a company that has soared 1,200% over the past three years.

The overall market has been softer this month down close to 3% but Nvidia’s results suggest that sector-specific growth drivers, particularly in AI, remain intact.

AI Demand Continues to Outpace Supply

Despite market volatility, analysts have repeatedly emphasized that demand for advanced AI chips is still running ahead of supply. Much of Nvidia’s recent success stems from the explosion of generative AI workloads following the debut of ChatGPT in late 2022.

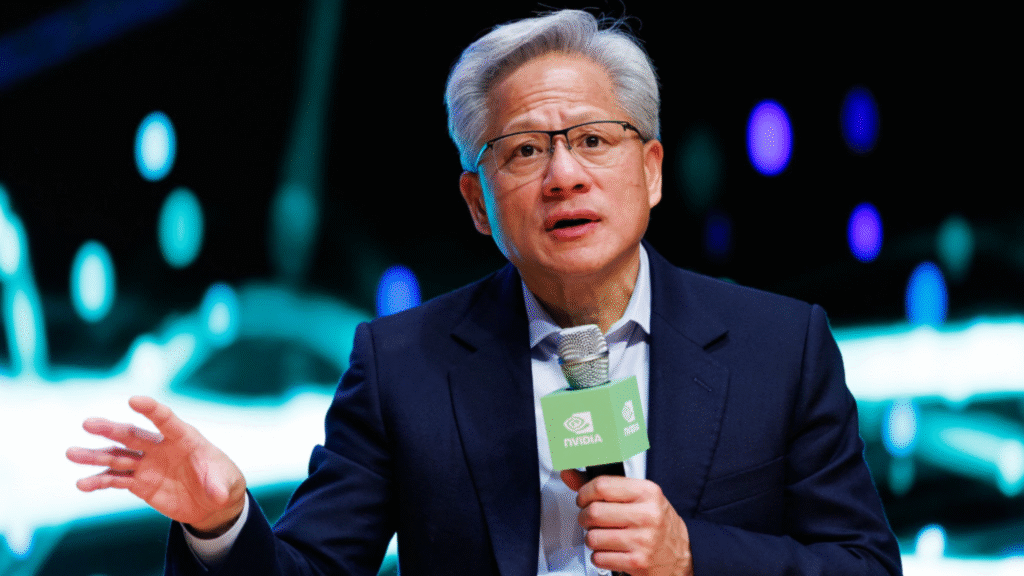

Adding to this momentum, CEO Jensen Huang recently disclosed that Nvidia has $500 billion worth of chip bookings lined up through 2026, a figure that underscores how aggressively companies are securing future inventory.

Big Tech Races to Expand AI Data Centers

Major cloud providers, some of Nvidia’s largest customers are accelerating multi-billion-dollar investments to scale up AI data centers.

Microsoft, for example, reported a record $35 billion in capital expenditures last quarter. Around half of that was directed toward acquiring AI chips and expanding compute capacity.

As these companies compete to build the most capable AI infrastructure, Nvidia remains the supplier they rely on for cutting-edge GPU technology.

Margins Remain Strong in High-Demand Environment

For the upcoming quarter, Nvidia expects an adjusted gross margin of 75%, plus or minus 50 basis points.

Analysts had been forecasting a slightly lower margin of 74.5%, making Nvidia’s guidance another positive surprise.

This margin strength indicates that the company still holds significant pricing power despite rising competition and tightening export rules for some markets.

What This Means for Investors

Nvidia’s latest outlook reinforces a key theme in today’s market: AI is still in a rapid expansion phase, and the companies building next-generation data centers are not slowing down. While concerns about elevated valuations remain valid, the underlying demand story for AI hardware continues to justify aggressive capital investment.

For now, Nvidia’s leadership position appears secure and its new revenue forecast shows that AI infrastructure spending is far from cooling.

Disclaimer:

This article is for informational purposes only and does not constitute financial advice, investment guidance, or a recommendation to buy or sell any security. Always conduct your own research or consult a licensed financial professional before making investment decisions.