Quantum Computing Stocks to Watch Now in 2025

Quantum Computing Stocks to Watch Now in 2025

Quantum computing is no longer science fiction, it’s becoming the next frontier of innovation. From cybersecurity to digital identity and semiconductor chips, this new era could reshape how the digital world operates.

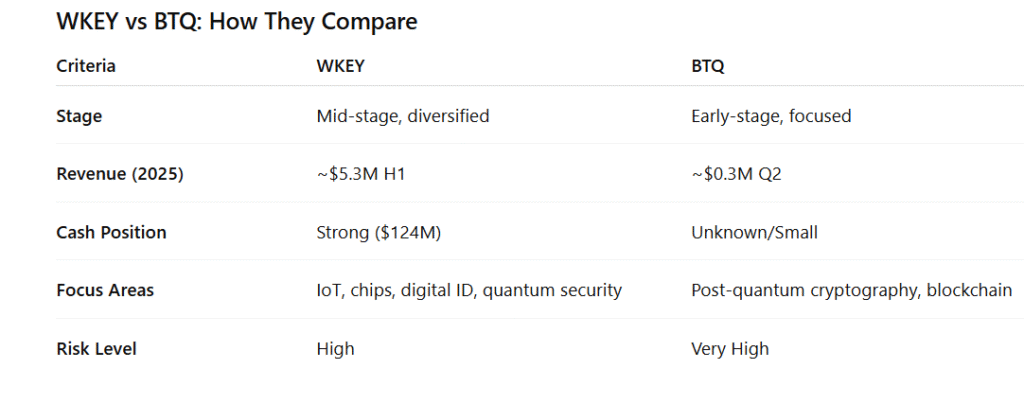

Today, we’re exploring two emerging players in this fast-changing space: WISeKey International Holding AG (WKEY) and BTQ Technologies Corp (BTQ). Both are chasing opportunities in quantum-resistant security and IoT (Internet of Things) technology.

Note: This article is for educational purposes only, not investment advice. Always do your own research before investing.

WISeKey (WKEY): Building Quantum-Resistant Foundations

WKEY is on a mission it calls “Quantum Convergence” combining semiconductors, digital identity, satellites, blockchain, and IoT into one secure ecosystem. Let’s break it down.

Financial Overview (H1 2025)

Revenue: $5.3 million, up slightly from $5.2 million last year.

Gross profit: $1.9 million, an increase from $1.1 million pushing gross margins from 21% to 35%.

This shows improvement in product efficiency, even if revenue growth is modest.

However, R&D spending nearly doubled (to $5.79 million), and operating losses widened to $27.3 million. That might look concerning, but it reflects heavy investment into new quantum-secure products.

Cash and Outlook

The company’s cash reserves jumped from $26.3 million to $124.6 million, signaling strong liquidity — likely from capital raises or asset conversions.

WKEY expects 2025 full-year revenue between $18–21 million, suggesting solid growth potential if execution stays on track.

Strategic Moves

Acquired IC’ALPS SAS, a French ASIC design firm, aligning with their custom quantum-chip vision.

Developing QVault TPM, a trusted platform module built to resist future quantum threats.

The TPM market could grow from $2.15 billion (2024) to $5.72 billion by 2031 that’s a 15% CAGR.

Bottom Line on WKEY

WISeKey offers speculative but interesting exposure to the quantum security and IoT space. With improving margins and a strong cash position, it’s setting up the groundwork for long-term potential but still far from profitability.

BTQ Technologies (BTQ): Betting Big on Post-Quantum Security

BTQ is even earlier-stage but its focus is sharp: post-quantum cryptography (PQC). In simpler terms, they build tools and infrastructure to keep blockchain and critical networks safe in the coming quantum era.

Revenue Snapshot

Q1 2025 Revenue: CAD 0.25 million, flat year over year.

Q2 2025 Revenue: CAD 0.31 million vs CAD 0.09 million last year.

Net loss: CAD 3.76 million.

These numbers highlight how early BTQ still is. Revenue remains tiny, but they’ve signed a $15 million deal with ICTK to develop quantum-secure chips, showing early commercial traction.

Strategy & Market

The post-quantum cryptography market is heating up fast as quantum computers threaten traditional encryption. BTQ wants to be part of that “quantum-safe” future, especially in blockchain infrastructure.

But this remains a long-term play. It’s a small company tackling a massive opportunity with equally high risks.

Bottom Line on BTQ

If quantum security takes off sooner than expected, BTQ could see massive upside. But if adoption lags, its small size and ongoing losses make it vulnerable. This one’s for investors who are comfortable with high-risk, high-reward technology stocks.

If you prefer diversified exposure and stronger financials, WKEY may look more stable.

If you believe in early-stage moonshots, BTQ could be your speculative pick.

Either way, both depend heavily on how fast the quantum era arrives and how well they can execute their strategies.

What to Watch in 2025

For WKEY: Can they meet revenue guidance (US$18–21M) and maintain higher margins?

For BTQ: Will partnerships like ICTK actually drive new revenue?

For Both: Will global cybersecurity laws and regulations accelerate the need for quantum-safe solutions?

The quantum computing revolution is still early but investors watching these companies are already positioning for what could be a once-in-a-generation technological shift.

Final Thoughts

Quantum security isn’t a trend, it’s the next defense line for a data-driven world. Whether WKEY or BTQ emerges stronger will depend on execution, adoption, and timing.

As always, invest wisely, think long-term, and stay informed.

Disclaimer

This article is for informational and educational purposes only and should not be taken as financial advice. Investing in emerging technology or penny stocks involves high risk, including loss of principal. Always conduct your own due diligence and consult a licensed financial advisor before making investment decisions.

Call to Action

If you found this analysis helpful, share it with fellow investors or subscribe to my newsletter for weekly deep dives into emerging tech stocks and market trends. Stay informed, your smartest investment is knowledge.