2 AI and Robotics Penny Stocks to Watch Now

2 AI and Robotics Penny Stocks to Watch Now

Imagine walking into a stadium or airport and being screened for threats in second, no long lines, no metal detectors. Now imagine a car that can “see” a cyclist hidden behind a van, or a radar system detecting a boat on a collision course long before it’s visible.

It may sound futuristic, but this is happening now and two small-cap companies are leading the charge: Evolv Technology Holdings, Inc. (NASDAQ: EVLV) and Arbe Robotics Ltd. (NASDAQ: ARBE).

Let’s break down why investors are watching these AI-driven innovators closely.

Evolv Technology (NASDAQ: EVLV) — AI-Powered Safety at Scale

Evolv Technology says it’s “pioneering AI-based solutions designed to create safer experiences.” Their systems are already screening people in schools, stadiums, hospitals, and other public spaces — over 3 billion people worldwide to date.

Their flagship products include:

Evolv Express® and Evolv eXpedite™ for concealed weapon detection.

Evolv Insights®, an AI-powered dashboard that gives security teams real-time analytics.

In essence, Evolv isn’t just selling equipment, it’s building a hardware + software ecosystem with recurring revenue from subscriptions and services.

Financial Snapshot (Q2 2025)

Revenue: $32.5 million, up 29% year-over-year.

Annual Recurring Revenue (ARR): $110.5 million, up 27%.

Adjusted EBITDA: Positive $2.0 million (a turnaround from a loss of $8.0 million).

Cash & Equivalents: $36.9 million with no debt.

Guidance: Full-year 2025 revenue growth raised to 27–30%.

These are healthy growth signals for a small-cap tech company, especially the move toward profitability and positive adjusted EBITDA.

The big picture: Evolv is scaling fast and executing well.

Opportunities and Strengths

Expanding into schools, airports, and entertainment venues.

AI-driven model makes their product smarter over time.

Recurring revenue base is growing steadily.

Strong balance sheet and raised guidance show momentum.

Risks to Note

Still unprofitable on a GAAP basis (net loss of $40.5 million).

Hardware rollout is capital-intensive.

Competition in AI-driven security is heating up.

Recent Highlights

Partnership with Buffalo Sabres and Spartanburg District Schools.

New software updates for easier tablet management and faster throughput.

Evolv is showing real traction. For investors seeking an AI stock with scalable growth and lower risk than early-stage startups, this one deserves attention.

Arbe Robotics (NASDAQ: ARBE) — The 4D Radar Powering Autonomous Vision

Arbe Robotics is developing 4D imaging radar technology — the next evolution of vision for cars, drones, and smart infrastructure.

Their claim: radar with 10x higher resolution than competitors. Arbe’s chips combine radar sensing, AI-based signal processing, and real-time environmental mapping.

Beyond cars, they’re expanding into maritime, smart infrastructure, and defense sectors — opening up multiple revenue paths.

Financial Snapshot (Q2 2025)

Revenue: $0.3 million (vs $0.4 million last year).

Net Loss: $10.2 million (narrowed from $11.7 million).

Cash: $62 million, providing a solid runway.

Full-Year Outlook: Revenue between $2–5 million; Adjusted EBITDA loss of $29–35 million.

Arbe remains pre-commercial, but it’s positioning for long-term adoption by automakers and infrastructure players.

Key Strengths

Recognized for innovation — winner of “Sensor Technology Solution of the Year” (AutoTech Breakthrough Awards 2025).

Expanding partnerships, like with Sensrad Ltd. for smart infrastructure and defense.

Strong IP moat in radar + AI integration.

Risks

Revenues remain minimal; the company is still in R&D mode.

Long commercialization timeline (mass deployment likely closer to 2028).

High cash burn and potential dilution risk if new funding is needed.

Verdict: Arbe is a high-risk, high-reward play. If it wins major automotive design contracts, the upside could be massive — but investors must have patience and a strong risk appetite.

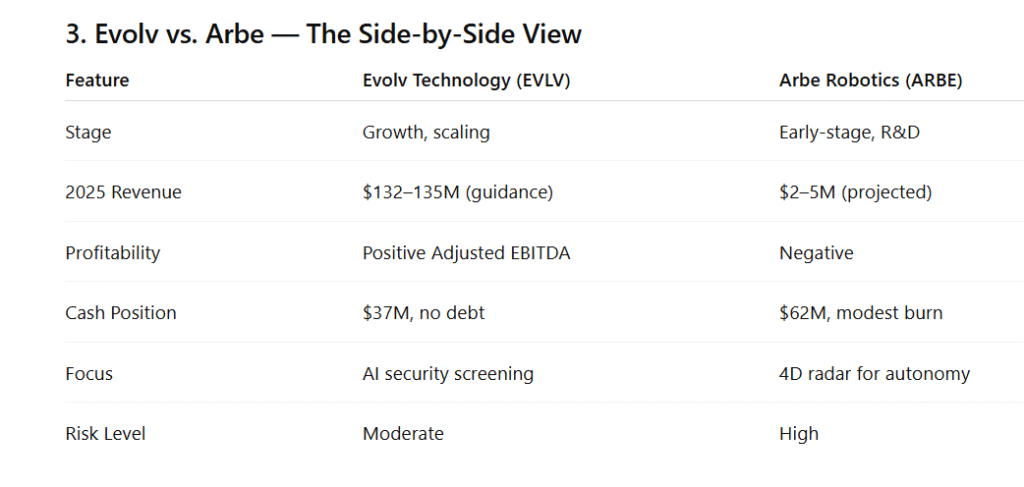

Investor Takeaway

- Evolv: A more stable small-cap growth play with rising revenue and real-world adoption.

- Arbe: A speculative bet on the future of autonomous technology with potentially massive upside if it commercializes successfully.

Both represent the kind of emerging tech themes — AI, robotics, and automation that could reshape industries in the next decade.

Bottom Line

If you missed early movers like NVIDIA or Palantir, these smaller innovators might offer the next wave of opportunity — but they come with different levels of risk.

Always research carefully, diversify your portfolio, and think long-term.

Disclaimer

This article is for educational and informational purposes only and should not be considered financial or investment advice. Investing in stocks, especially small-cap or penny stocks, involves risk, including possible loss of capital. Always conduct your own due diligence or consult a licensed financial advisor before investing.

Call to Action

If you enjoyed this analysis, explore more on Money Mind Finance for in-depth research on AI, robotics, and emerging tech stocks.

Subscribe to our newsletter to stay updated on hidden gems shaping the future of technology and investing.