Top 2 Defence Tech Stocks Under $11 to Watch

Top 2 Defence Tech Stocks Under $11 to Watch

Drones are no longer just toys, they’re transforming modern warfare, surveillance, and even public safety. Across battlefields, borders, and cities, unmanned systems are becoming a crucial part of global defence.

Today, we’re taking a close look at two emerging defence technology stocks trading under $11 — Draganfly Inc. (DPRO) and Red Cat Holdings (RCAT).

Both are small but ambitious players in the drone, robotics, and ISR (Intelligence, Surveillance, and Reconnaissance) markets. Each claims progress, each faces risk and both could see meaningful growth if they execute right.

This article is for educational purposes only. It’s not financial advice, investment guidance, or a buy/sell recommendation. Always do your own due diligence before making investment decisions.

- Draganfly Inc. (NASDAQ: DPRO)

What Draganfly Does

Draganfly Inc. is one of the oldest names in drone innovation, offering hardware, software, and drone services for defence, public safety, agriculture, mapping, and environmental monitoring.

With over 25 years of innovation, Draganfly positions itself as a “full-stack, NDAA-compliant” (U.S.-approved) drone provider, a key advantage in an era where 80% of U.S. public safety drones are still foreign-made.

That’s a strategic opening for North American-built drone systems.

Market Outlook

The global UAV (Unmanned Aerial Vehicle) market could grow from tens of billions today to between $73 billion and $220 billion by 2032, depending on the source.

That gives companies like Draganfly a large and expanding opportunity, if they can scale production and maintain competitiveness.

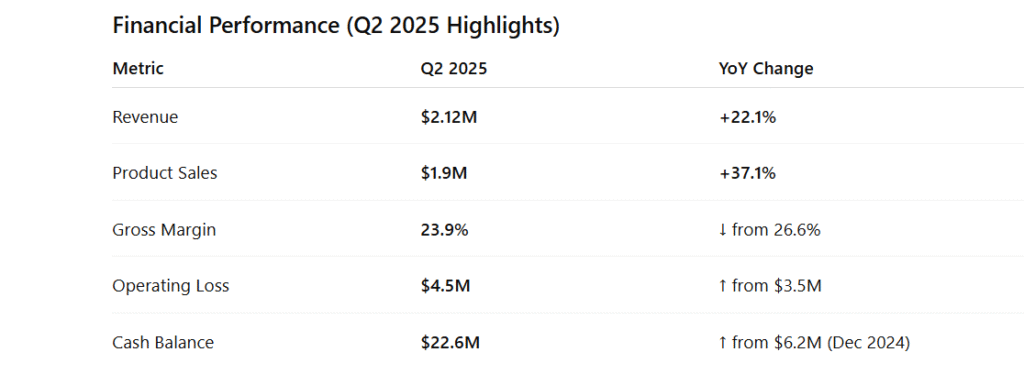

🔹 The good: Revenue growth is strong, cash runway looks solid, and product sales are up significantly.

🔹 The concern: Margins are tightening, losses are widening, and the company remains unprofitable as it invests heavily in expansion.

Still, that cash increase from $6.2M to $22.6M gives it the financial runway to sustain R&D and operations.

Key Strategic Moves

Partnership with Global Ordnance (Oct 2025): Accelerating U.S. defence adoption and production support.

Collaboration with Palladyne AI Corp: Advancing autonomous drone swarming, a major military growth area.

Selected by the U.S. Army (Sept 2025): Supplying its Flex FPV drones for military use.

U.S. Manufacturing Expansion (Aug 2025): Boosting domestic capacity to meet “secure supply chain” demand.

Each of these moves strengthens its defence presence and long-term growth potential, if execution matches the narrative.

The Investment Outlook

Draganfly is still early-stage and unprofitable, but the themes are compelling —

Defence tech

Secure U.S. manufacturing

Growing domestic drone demand

Investors should expect volatility and long timelines. It’s a “growth opportunity” stock, not a “safe” one.

2. Red Cat Holdings (NASDAQ: RCAT)

Company Overview

Red Cat Holdings is a U.S.-based defence technology firm providing drone and robotic solutions for national security through subsidiaries Teal Drones and FlightWave Aerospace.

Their product lineup includes:

Black Widow™ ISR drone system

FANG™ FPV drones

Blue Ops, a new division focused on uncrewed surface vessels (USVs)

This isn’t a hobby drone maker, it’s a company chasing U.S. government and defence contracts in land, air, and sea robotics.

Strategic Milestones

TD3 LRP U.S. Army Contract: Delivering up to 690 Black Widow systems, a potential game-changer.

AS9100 Certification: Achieved aerospace-grade manufacturing standard, a must for defence contractors.

Partnership with ESAero: Expanding manufacturing capacity.

Launch of FANG Drone Line: Low-cost, NDAA-compliant FPV drones for defence applications.

Blue Ops Expansion: Entering the maritime defence tech market.

$150M Public Offering (Sept 2025): Strengthens balance sheet but may dilute shares.

This combination of contracts, certifications, and diversification positions Red Cat for scale — but also introduces execution risk.

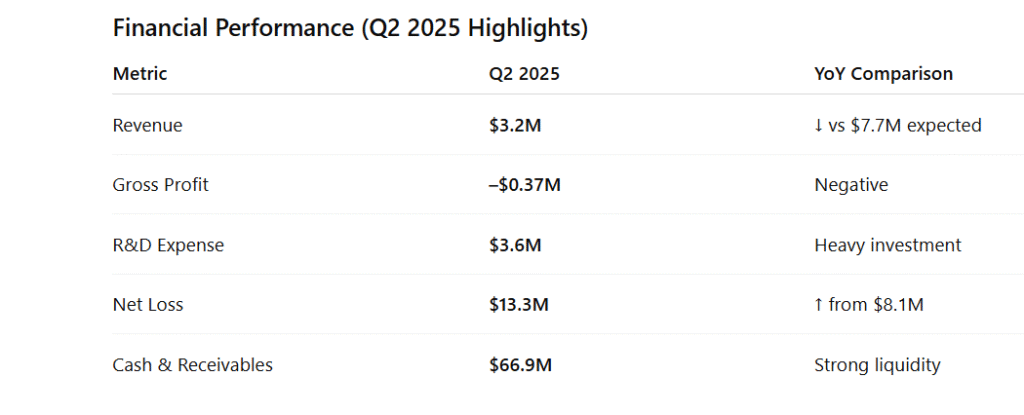

🔹 Positives: Solid liquidity, major U.S. Army contract, expanding into new domains (air + sea).

🔹 Concerns: Missed revenue expectations, heavy quarterly losses, still pre-profit stage.

Analyst Sentiment

Some analysts see strong long-term upside if Red Cat capitalizes on the U.S. military’s drone modernization efforts through 2026.

However, the jump from $3.2M in revenue to projected $80–$120M for 2025 is ambitious — and delivery risk is high.

This is a classic “high risk, high potential” setup.

If these companies can convert contracts into sustained revenue, they could benefit from the global drone-defence boom.

But investors must be patient — these are speculative growth stocks, not dividend plays.

Call to Action

For more deep dives into emerging tech, defence, and AI stocks, subscribe to the MoneyMind Finance Newsletter — where facts meet smart investing.

⚠️ Disclaimer

This content is for educational and informational purposes only. It does not constitute financial advice, stock recommendations, or investment solicitation. Always perform independent research or consult a licensed financial advisor before making investment decisions.