Top Stocks Under $6 to Buy in 2025

Top Stocks Under $6 to Buy in 2025

Imagine a future powered by artificial intelligence, electric vehicles, and massive data centers running 24/7. The question is, who builds the backbone of this new world? Who supplies the raw power and materials to keep it running?

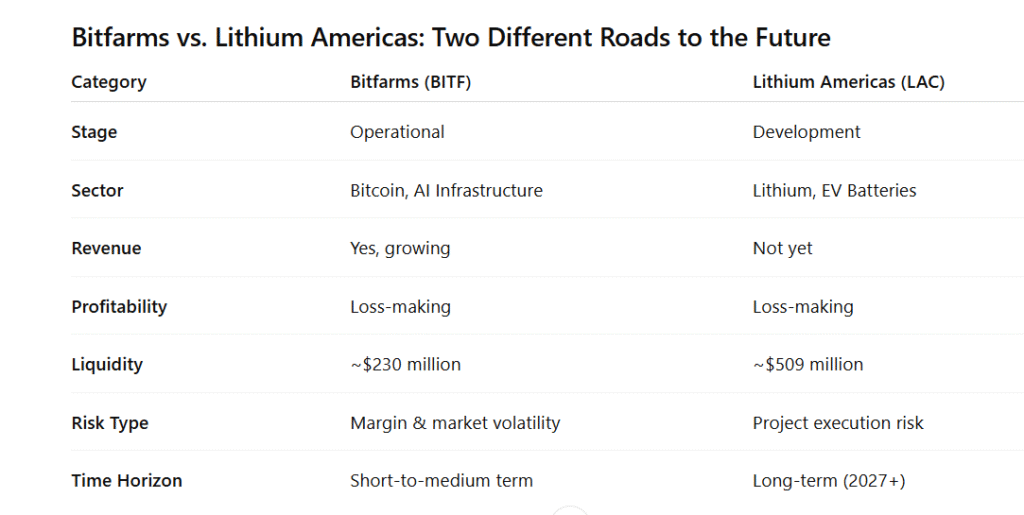

That’s where Bitfarms (BITF) and Lithium Americas (LAC) step in. One provides the computing infrastructure that powers Bitcoin and AI data centers. The other supplies lithium, the metal behind every electric vehicle battery.

Both companies sit at the crossroads of major global megatrends. But while they show great potential, their financial health tells two very different stories.

Let’s dive into their Q2 2025 results, business shifts, and what investors should really pay attention to.

Bitfarms (BITF): From Bitcoin Mining to AI Infrastructure

Bitfarms is a global data center operator focused on Bitcoin mining and high-performance computing (HPC) for AI. With 14 data centers, 410 megawatts of capacity, and 17.7 exahashes per second (EH/s) of computing power, it’s among the industry’s bigger names.

Q2 2025 Financial Highlights

Revenue: $78 million, up 87% year-over-year.

Gross Margin: 45%, down from 51% a year ago.

Operating Loss: $40 million (including $15 million in impairment and $37 million in depreciation).

Adjusted EBITDA: $14 million (18% margin vs 28% last year).

Liquidity: $230 million (cash + Bitcoin holdings).

Despite strong revenue growth, margins are tightening and losses continue to widen. The drop from 51% to 45% in gross margin highlights the pressure of rising electricity and equipment costs, and potentially tougher Bitcoin mining conditions.

However, Bitfarms is not standing still. The company is pivoting toward AI infrastructure, partnering with T5 Data Centers and securing a $300 million facility from Macquarie to expand its Pennsylvania data center. This could make Bitfarms a future player in the booming AI computing market — but execution is key.

Key Takeaways for Investors

Upside: Revenue is growing fast, and the AI pivot adds a new growth story.

Risks: Shrinking margins, ongoing losses, and Bitcoin’s volatility.

Watchlist Items: Mining recovery, AI contracts, and capital-raising risks.

If you believe in the long-term growth of AI and decentralized computing, Bitfarms could be one to watch but it’s still in a transition phase.

Lithium Americas (LAC): Building the Future of Electric Vehicles

On the other side of the energy transition is Lithium Americas, the company developing the Thacker Pass lithium project in Nevada, one of the largest lithium deposits in North America. It’s backed by General Motors and supported by a U.S. Department of Energy loan, making it a key player in America’s push for domestic EV battery supply.

Q2 2025 Financial Highlights

Cash and Restricted Cash: $509 million.

Capital Expenditures (CapEx): $124.8 million in Q2; $574 million total capitalized so far.

Design Progress: 70% complete, targeting 90% by end of 2025.

On-Site Workforce: Over 300 workers, expected to reach 1,800 by 2027.

Net Loss: $24.8 million vs $12.8 million last year.

Lithium Americas is still in development mode, with heavy investment before production begins. It’s a long-term bet — no revenue yet, but high potential if the EV boom continues. The company’s large cash reserves give it breathing room, but its liabilities are growing as construction ramps up.

Key Takeaways for Investors

Upside: Positioned at the center of the EV and lithium supply chain.

Risks: Cost overruns, regulatory hurdles, and lithium price volatility.

Timeline: Thacker Pass Phase 1 is likely years away from full production, making it a long-horizon play.

If you’re patient and believe in the EV revolution, LAC could be a strategic way to invest early in U.S. lithium production.

If you prefer near-term revenue and AI exposure, Bitfarms could appeal. But if you’re betting on EV growth and long-term lithium demand, Lithium Americas offers a strategic position.

Both come with high risk and high reward, depending on your investment horizon and conviction in their industries.

Final Thoughts

Bitfarms and Lithium Americas are two very different plays on the same theme, the future of power, data, and mobility. One is transitioning from Bitcoin to AI; the other is building the raw material base for the EV era.

Both companies have potential upside, but also clear financial and operational risks. For investors, the key is patience, diversification, and staying informed.

👉 If you enjoyed this analysis, check out our latest stock breakdowns and weekly market news. Follow MoneyMind Finance for more smart investing insights tailored to investors.

Disclaimer

This article is for informational and educational purposes only. It is not financial advice or a recommendation to buy or sell any stock. Always do your own research or consult a licensed financial advisor before making investment decisions.